The Ethylene Market

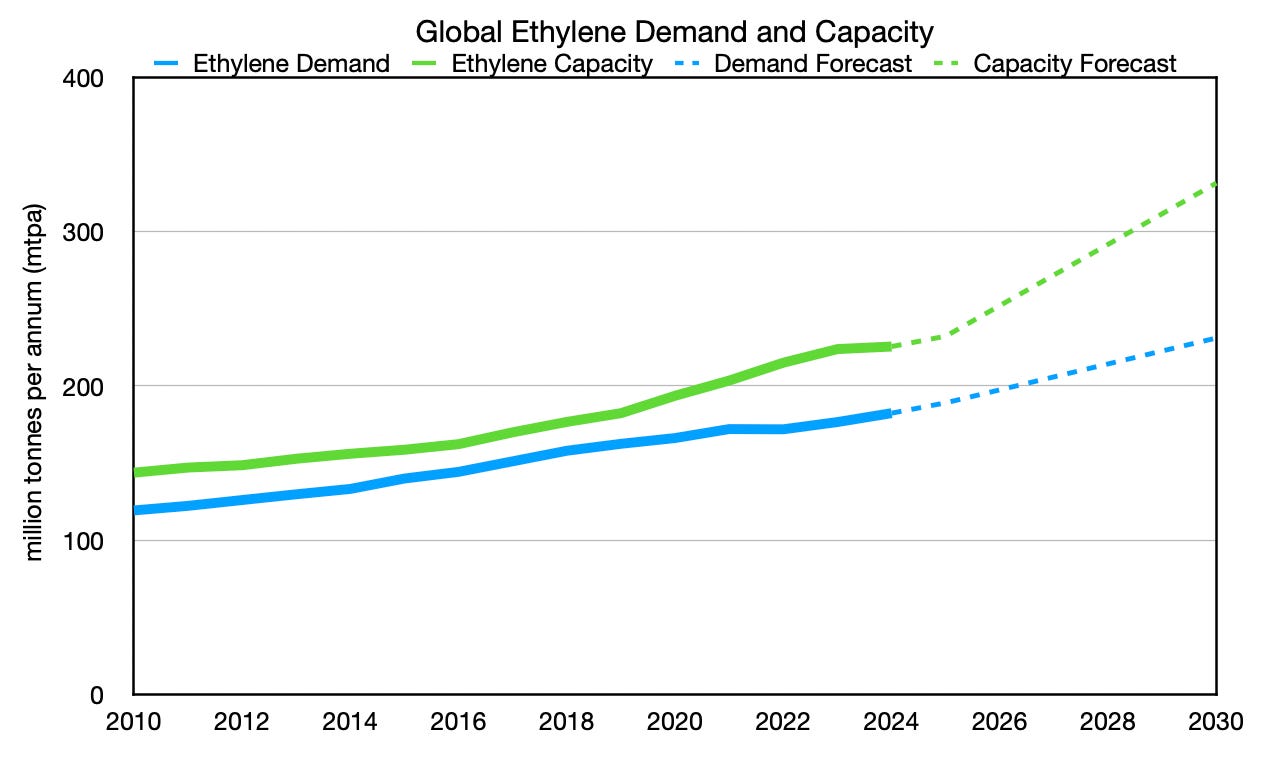

Ethylene (H2C=CH2) is a hydrocarbon gas that is used as a building block to make plastic, among many other applications. There is currently a large excess of ethylene production capacity globally and the excess is set to grow even larger as the chart below shows. (Data from S&P via Financial Times, 2030 forecasts from GlobalData via Offshore Technology)

It is typical for plants to run below capacity, but “anything below 90% is a source of concern; 85% is bad, and 80% is seen as catastrophic." The global average utilization is around 80% in 2024, so the widening gap between capacity and demand means capacity closures are inevitable.

It might look like the manufacturers are crazy to build so much excess capacity, but what’s actually happening is lower cost producers are pushing higher cost producers out of the market.

The capacity additions are primarily coming from China, the Middle East, and North America. The Middle East and North America have a major cost advantage. The cost of ethylene production is dominated by the cost of feedstock and energy. Ethylene can be produced using naphtha from crude oil as a feedstock, but the cheapest and most efficient feedstock is ethane (H3C-CH3), which is the lightest natural gas liquid (NGL): “The reaction path to use ethane to produce ethylene is much shorter, the yield higher, and the production cost lower.” The Middle East and North America have both abundant ethane and abundant natural gas for energy, giving them a double advantage on cost of production.

China doesn’t have the same advantages as the Middle East and North America, but it does have the advantage of a closer relationship with the Middle East, and China is more likely to support the industry for strategic self-sufficiency with less concern for profit. Also, some of the new facilities in China will be importing ethane from the US. China is currently the world’s biggest importer of ethylene (29% of global imports in 2022), but it is expected to be self-sufficient by 2030 and "regional trading volume is expected to decline until the end of the decade."

Capacity closures will take place in higher cost regions like Europe, Singapore, South Korea, Japan, and Taiwan. Some European producers are already importing US ethane in order to remain competitive. US ethane exports are forecast to continue rising, but the exports are limited by the capacity of ethane-based crackers (ethylene production facilities) on the import side.

Due to an overabundance of ethane in the US that is still growing and ethane import markets not keeping pace, companies are building ethane to ethylene crackers, ethylene export terminals, and ethylene derivative facilities on the US Gulf Coast.

There is currently a large spread between US ethylene prices and prices in other markets, but the spread should narrow as more LNG, ethane, and ethylene export capacity comes online, and as the wave of new global ethylene production capacity brings non-US prices down.

Currently, US ethylene exports are primarily headed to Asia and Europe, but as China becomes self-sufficient, exports will likely shift to Europe, displacing European production. Europe produced 16.5 million tonnes in 2022, which is much larger than the total international trade of 7.1 million tonnes in 2022, so the displacement of European production allows room for potential trade growth despite reduction of trade to China, which accounted for 2.1 million tonnes in 2022. However, some European producers have low enough costs to survive and more may transition to lower costs using US ethane, so only some of European production will be displaced by imports. There is also the possibility that the Europe Union could implement tariffs to protect its chemical industries.

The primary ethylene trade implications are likely to be a reduction in trade in Asia as China becomes self-sufficient and an increase in trade to Europe from the US and Middle East as European production is displaced by lower cost imports. However, it’s possible that tariffs, exports of LNG and ethane to Europe, resumption of Russian gas imports to Europe, or rising natural gas prices in the US could reduce the ethylene price spread to below the cost of shipping, which would stifle the trade to Europe.

Thank you for this excellent article.

Which European and US companies will suffer the most from this?

Also, since it is a building block to make plastics, many chemical companies will benefit from lower prices, no? Which ones?