ZIM Integrated Shipping ($ZIM)

Massive profits from Red Sea disruption, but does it change the equation?

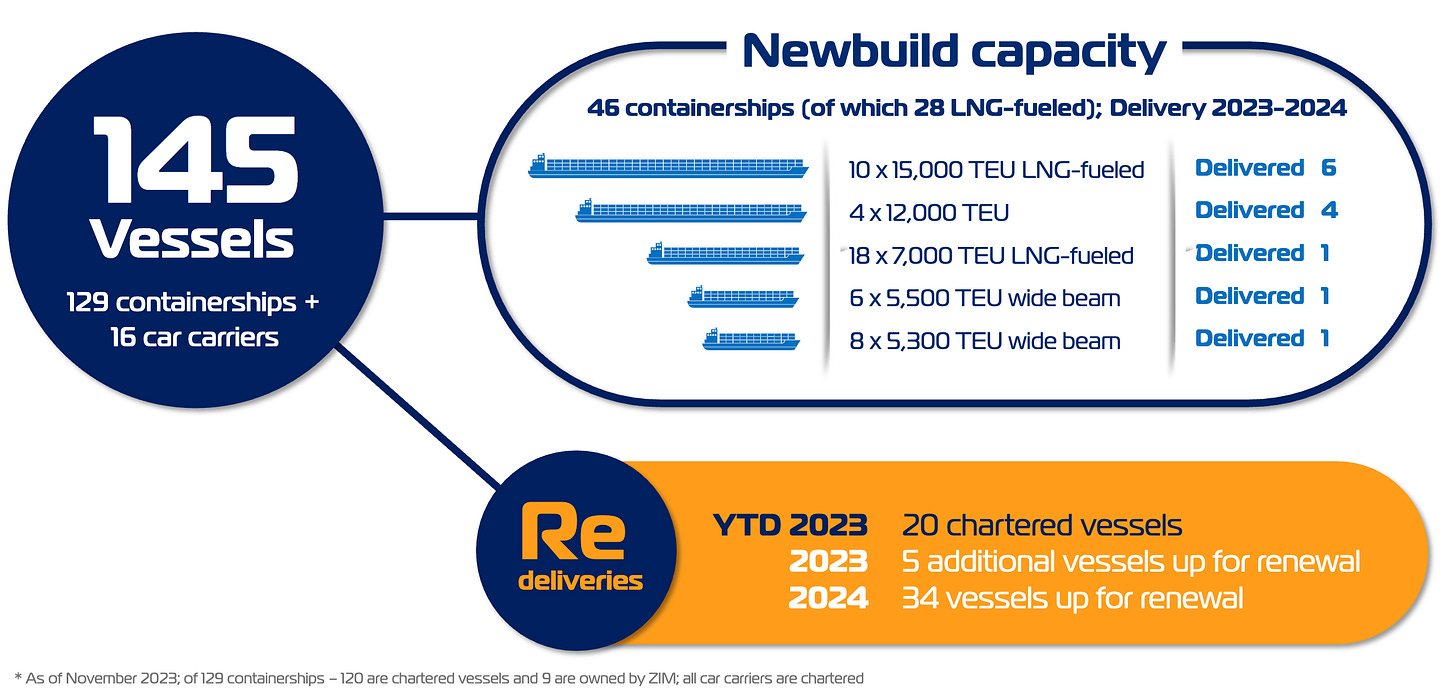

ZIM is a shipping company operating 129 containerships and 16 car carriers as of their latest report. Nine containerships are owned and the rest of the fleet is chartered in. They are making a LOT of money right now due to the disruption of traffic through the Suez canal resulting from Houthi missile attacks on commercial vessels in the Red Sea.

Jeffries estimates $6.25 2024 EPS, and $24 running EPS at current rates, meaning that they would make about half of the current market cap if the disruption runs for one quarter!

I estimate $5.20/share of quarterly free cash flow at current rates based on the 2023 Q3 fleet plus more from newbuild deliveries they got since Q3. So I agree with Jeffries that they are making a lot and the Red Sea situation is ongoing so this could continue for a while.

Although this initially sounds outrageously bullish, it's not clear that shareholders will receive any of the profits...

Prior to the Red Sea situation, ZIM was losing a lot of money.

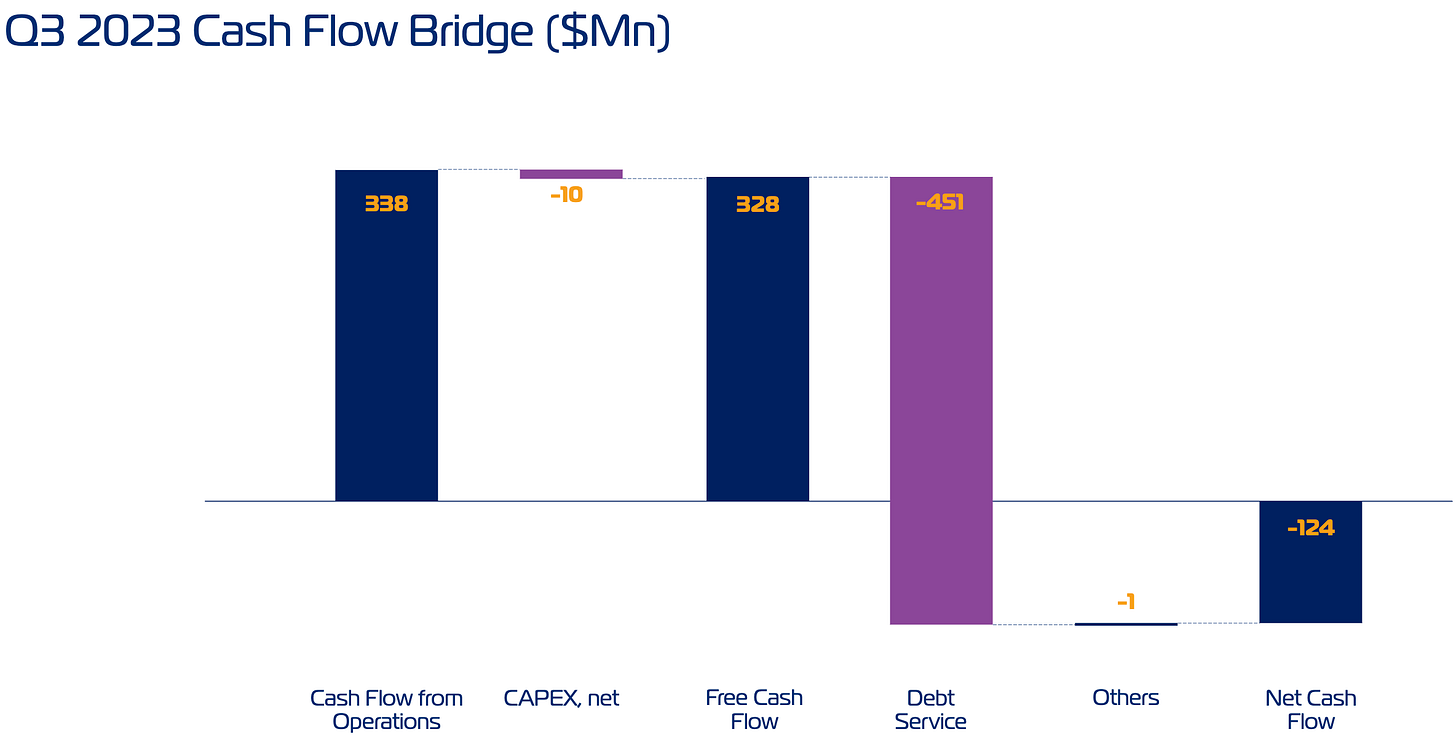

The "free cash flow" chart is a bit deceptive because "debt service" is not accounted for in the "free cash flow" despite the fact that "debt service" is composed of interest and lease payments which should probably be subtracted from "free cash flow" for better representation of how much they are actually making. This "debt service" is not prepaying a one-off debt, it's more like a perpetual operating expense.

According to the most recent annual report, "As of December 31, 2022, the remaining average duration of our chartered fleet was approximately 26 months."

As of the last quarterly report, they had $4.62B in lease liabilities which comes to about $533M per quarter if we were to assume the average duration is still 26 months, though it should be a bit higher now.

This means that the real free cash flow was what they call "net cash flow", but it's even worse because in the 2023 Q3 earnings call they mentioned that there was a one-time benefit of $100M due to the timing of payments, so the burn rate as of 2023 Q3 was about $224M per quarter or around $900M per year. Q4 is definitely going to be even worse than that because rates were even lower.

ZIM was smart enough to keep a big pile of cash and bonds to weather this period of losses. As of 2023 Q3 they had about $3.1B of cash and bonds, which would be enough to survive for over 3 years at a $900M/year burn rate.

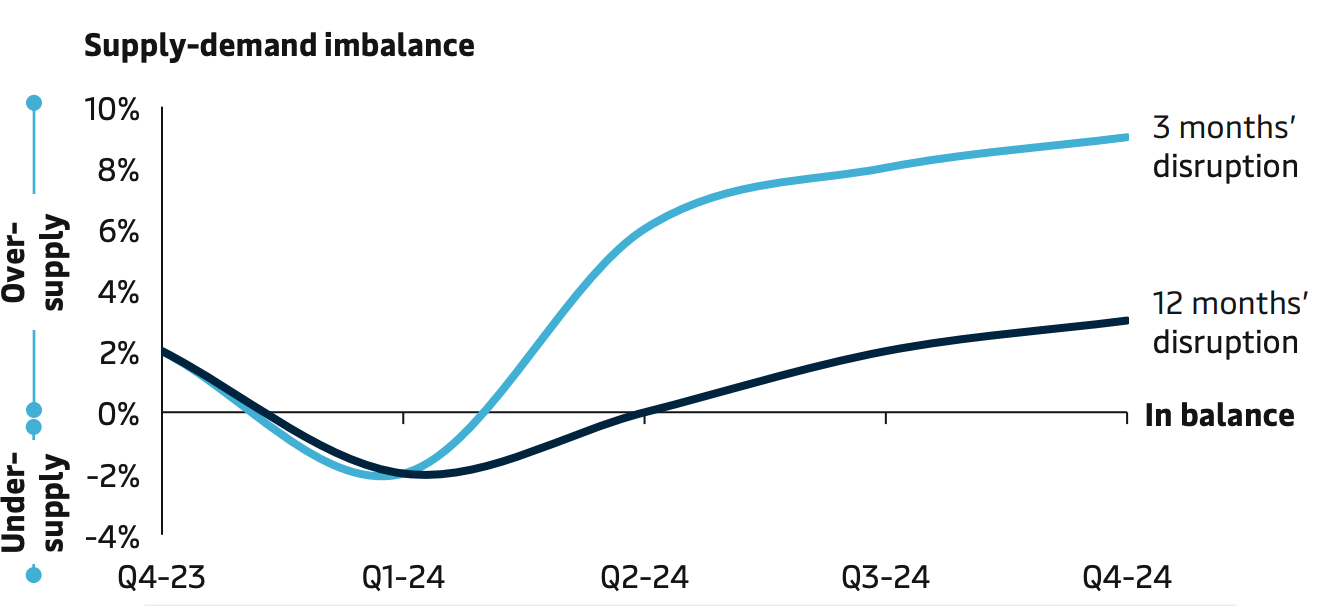

The problem is that we don't know how long the current depression will last, and the burn rate will likely get worse after the Red Sea disruption as the worldwide containership fleet takes on a continual flood of newbuilds over the next year, with oversupply predicted to widen in 2024 , and ZIM takes on a ton of new long-term charters for its contractually locked-in fleet renewal plan.

Although ZIM isn't planning on growing much in terms of number of vessels, they are growing in terms of total TEU (20ft container) capacity and with newer ships, the lease rates will be higher. They will be anxiously redelivering their older tonnage as soon as the leases expire, partially offsetting the new leases. 34 vessels are scheduled for redelivery in 2024.

ZIM is leasing 46 containership newbuilds that are being delivered between 2023 and 2024 that they contracted in 2021 and 2022. Only 13 of these had been delivered as of the 2023 Q3 report meaning that the majority of them are still coming in and will potentially compound the rate of losses beyond what we saw in 2023 Q3 if the Red Sea situation resolves.

Furthermore, these long-term leases haven't hit the balance sheet yet: "A lease... is initially recognized on the date in which the lessor makes the underlying asset available for use by the lessee."

So as all these vessels are delivered, the lease liabilities on the balance sheet are going to increase. I estimate there are around $5B of new lease liabilities coming since the last report (Q3) when lease liabilities were $4.62B. (I couldn't find all the data, so this is a rough estimate, but it's big regardless.) Some older leases will be getting paid down, but they’ll be replaced with newer leases at higher rates and longer durations.

So let's imagine that we fast forward until after the Red Sea situation resolves, whenever that might be. Say ZIM made over $1B in free cash flow during the disruption and the cash hoard is now up to $4B (after some losses in Q4), but they are losing $1.5B per year due to a worsening of containership oversupply and higher lease costs from the newbuilds. (These numbers are complete guesses but we need to assume something to get an idea of what the future might look like.) This is not a situation where it would seem prudent to be paying out dividends. Despite their previous dividend policy, I would expect them to be hoarding as much cash as possible at this point.

The key point is that almost regardless of how much money they make during the Red Sea disruption, the only prudent thing to do will be to hoard it try to survive the disaster of a situation they will likely be in afterwards. So shareholders will probably have to wait until a sustained return to profitability before any substantial shareholder returns, which could be years away. ZIM management said on the Q3 earnings call “we expect that the industry will be under severe pressure and challenged for the foreseeable future,” though they also said “we believe the '25 will mark a turning point for ZIM and return to profitability.” It’s hard to be convinced that 2025 will be profitable given 10% world fleet capacity growth in 2024 (3.1M TEU) and another 3M TEU between 2025-2026 while demand is only expected to grow around 3-4% in 2024. Some analysts think the market could be oversupplied until 2030 or beyond.

Maybe they won't be so cautious and they'll pay out dividends regardless, but I wouldn't count on management risking the company for the sake of the shareholders.

The best case for bulls is that the Red Sea situation lasts for a very long time, but even then, Maersk has said that newbuild deliveries will overpower the impact of the Red Sea disruption by 2024 H2.

The Houthis also have a plan to issue permits for safe passage through the Red Sea, which could alleviate the disruption even without a ceasefire. Although it's not clear if liners would participate in this scheme, they do have a lot of economic incentive to utilize the Suez canal. ZIM would not be eligible, however, since it is an Israeli company.

Despite the massive current profits, this looks like a temporary reprieve from a very bleak situation. To make this a compelling buy I would need to see major upward moves in some combination of containership demand, scrapping, blanking, and slow-steaming. If you have conviction that the current depression will be much shorter than analysts expect, then that cash hoard could be unlocked and you could make a lot of money, but I don't have that conviction. I’d like to return to this and reassess when we can clearly see the light at the end of the tunnel for the containership market.

I certainly would not short it right now though because the market may be surprised by how much money they are currently making when the 2024 Q1 numbers are announced which may be in the upcoming Q4 call if they issue guidance, or might have to wait until the Q1 report if they don't issue guidance. There's a chance this could cause a surge in the stock price leading to a short squeeze with very high (28%) short interest.